Job estimate vs invoice: What's the difference?

This article provides a complete overview of Job Estimate vs Invoice and how to make the most of each of these documents to keep your finances in order.

Businesses have to deal with a ton of paperwork and numbers for every sale or service they offer. Two important documents that are part of this paperwork are invoices and estimates.

Even though both terms often get mixed together, they have different jobs to do. One is created based on predictions, while the other is evaluated based on completed sales or services.

However, this is just a basic overview of Job Estimate vs Invoice.

In this article, I’ll explain some of your questions like:

- What is a job estimate?

- What is an invoice?

- What are the key differences between an estimate and an invoice?

Read along to understand how to make the most of each of these documents to keep your finances in order.

What is a job estimate?

A job estimate is a document that gives you an approximate idea of how much a project or service will cost before any work is done.

Estimates are not the same as invoices. They're only an educated guess of what the final cost may be, based on the details provided. The client doesn't owe you anything when you send them an estimate.

A job estimate or quote is used before a project begins, during the negotiation or planning stage. Sending an estimate is a common practice in industries like construction, home services, repairs, and even creative fields like graphic design or web development.

How is a job estimate created?

The service provider reviews the project details and calculates costs based on resources and deliverables to produce a job estimate.

Some may use industry-specific estimating software, but many still prepare them manually, using standard pricing guides or past experience as a reference.

A job estimate form usually includes:

- A breakdown of costs, such as labor and materials

- A timeline or estimated completion date

- The scope of work, which explains what’s involved in the project

- Terms and conditions which cover payment terms, warranties, or potential extra charges

Types of job estimates

There are 4 main types of job estimates:

- Preliminary Estimate: It is an early-stage, rough evaluation of the cost for a project using basic information when full details aren’t worked out yet. The purpose of a preliminary estimate is to determine if the project is within budget before investing too much time or money into planning.

- Detailed Estimate: This is a more accurate estimation made after all project planning has been established and the breakdown of all costs related to labor, materials, machinery, and other expenses developed. Specific information on the project, such as measurements and material, is needed to create a detailed estimate.

- Quantity Estimate: This type of job estimate predicts the amount (or quantity) of resources needed for the job. It is very helpful, especially in construction projects where accurate measurements and quantities of bricks, concrete, wood, etc., are required.

- Bid Estimate: A bid estimate is used when a service provider or contractor is competing for a project. It’s a formal proposal that includes all estimated costs and is submitted to the client or project owner, who then compares bids from multiple providers.

Now that we have seen what a job estimate is, let’s now take a look at what does invoice means in business.

What is an Invoice?

An invoice is basically a legal document that businesses send to their customers or clients to request payment for goods or services they deliver.

It’s a formal way to let the customer know how much they owe, when the payment is due, and what exactly they’re paying for.

The invoice is sent after the completion of the project. It is also used in recurring billing situations, like for subscriptions or monthly services.

If you’re a registered business in the U.S., you must keep a record of all previously sent invoices for at least 3 years according to the IRS requirements.

Freelancers also use invoices to bill their clients for the work done on a particular project.

How is an invoice created?

Invoices are usually created using accounting or invoicing software. You can create one from scratch manually or use a template and edit it as per your needs.

Here are the details an invoice includes:

- An invoice number

- The date the invoice is issued

- The name and contact details of the person or company being billed

- The name and contact details of the business sending the invoice

- A breakdown of what was provided, including quantities and unit prices

- The total price with taxes or discounts added in

- When the payment is due and how the customer can pay (like via bank transfer or credit card)

Types of invoices

Like job estimates, invoices also have different types. Here are some common ones:

- Standard Invoice: This is the most common type of invoice used in everyday transactions for businesses. It includes all the necessary details like the client’s info, the service provider’s details, a breakdown of services or products, and the total amount due.

- Recurring Invoice: This is used when a client is billed regularly (usually on a monthly basis) for the same services or products, like a subscription or monthly retainer. Recurring invoices save time by automating the billing process for ongoing work.

- Credit Invoice: A credit invoice is issued when a refund or discount needs to be applied. If the client overpaid or if there was an error, the credit invoice shows the amount the seller is returning or adjusting.

- Debit Invoice: A debit invoice is the opposite of a credit invoice. It’s used when additional charges are applied after the original invoice was sent. For example, if extra services were added later or if the first invoice erroneously mentioned less than the decided amount, the debit invoice will be used.

Key difference between job estimate vs invoice

The primary differences between a job estimate vs invoice are the timing of the generation of both documents and their legal standing.

They both serve different purposes and hence differ in multiple business aspects.

Here’s a quick invoice vs estimate comparison.

Tips for making invoices and estimates

Estimates and invoices are a critical aspect of your communication with your customers and clients. You must present them in a way that reflects your professionalism and reliability to make a positive and lasting impression.

Here are some simple tips to help you ensure your financial documents are organized, and easy for clients to understand.

- Automate your processes: You can save yourself from embarrassment of human errors when you invest in invoicing software. Automated solutions save you time and also track your invoices for you. Automated reminders are sent if the payment is overdue.

- Personalize your invoice: A personalized estimate/invoice strengthens your relationship with the client. Always include your business logo, contact information, and a friendly greeting before requesting payments.

- Include terms and conditions for payment: Specify your payment terms, such as late payment fees and accepted payment methods. T&Cs set expectations upfront and provide legal backing for you if payment issues arise.

- Be super transparent: Break down all the costs so that your client knows exactly what they’re paying for. Itemize services, materials, labor, and any additional fees. If the final amount differs from the original estimate, explain why.

- Send a thank you after being paid: Once a client has paid, send a quick thank you note along with a receipt or confirmation of payment.

- Mention taxes and discounts separately: Always separate taxes and discounts on your invoices and estimates so clients know the exact breakdown of what they owe and how discounts have been applied. It is also a legal requirement to clearly indicate taxes.

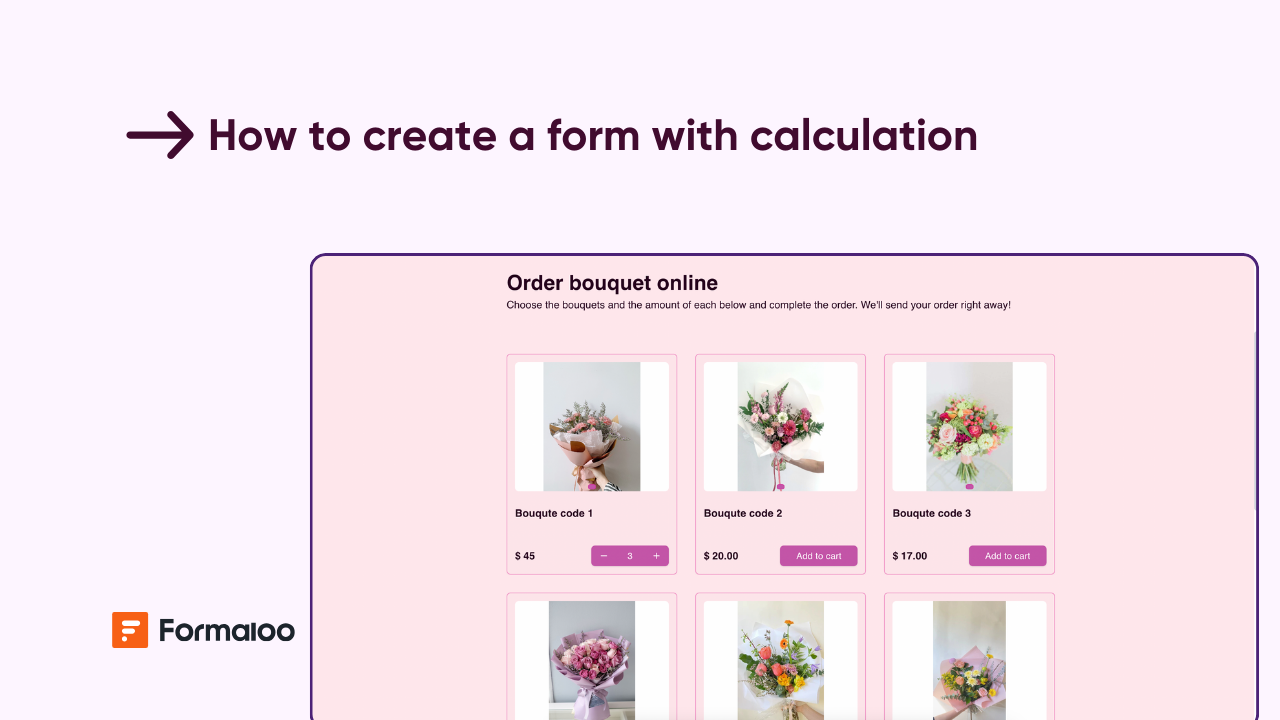

Automate business forms with Formaloo!

Estimates and invoices, both are important elements of business transactions.

With Formaloo, you can automate your invoices and estimate forms to save time, reduce errors, and make sure your calculations are always accurate.

Formaloo also allows you to use a customizable job estimate template from its library of dozens of templates so you maintain professionalism and consistency in your business forms.

Additionally, well-designed estimate forms can capture leads and provide potential customers with clear and reliable pricing.

Start automating your forms with Formaloo today!

FAQs

What is the difference between an invoice and an estimate?

The main difference between estimate vs invoice is that a job estimate is created before a project starts, it is subject to change, and is not a legally binding document. An invoice, on the other hand, is sent after you have delivered the work. It is final and it is of legal importance as well.

Should I send an invoice or estimate?

Whether you should send an estimate vs invoice depends upon where your project currently stands. If you are still in the discussion with your client about how a project should proceed, you should send an estimate. However, if you have completed the work and you need to get paid for your service, you should send an invoice.

Is an estimate the same as a bill?

No, the bill and estimate are two different business documents. An estimate is the proposal for the project. A bill, however, is the document that summarizes the work done and if the due amount has been paid. Bills are used for record-keeping purposes, but an estimate is to determine if both parties can proceed with the project.